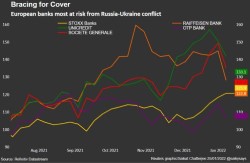

Stocks in major European markets fell to fresh lows on Thursday as the standoff between Russia and Ukraine escalated after days of gloomy trading amid growing concerns.

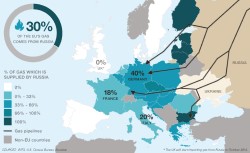

Crude and natural gas prices rose to multi-year highs on fears of supply disruptions and should continue to rise even more. The unexpected event has reinforced expectations of rising inflation, which has hit many hard, and analysts predict it will be unmanageable in the short term.

European stock markets tumbled.

Global financial markets were in turmoil on Thursday due to the confrontation between Russia and Ukraine.

The FTSE 100, the most widely-held index of U.K. blue chips, closed lower after falling 3.88% to 7,207.01. The Paris CAC 40 was down 3.83% at 6,521.05 cents. Germany's most important stock market index, the DAX, fell 3.96% to 14,052.10.

Russia-linked FTSE 100 companies were among the biggest losers. With tough new sanctions looming, their companies could take a huge hit, with no sign of relief in sight given the magnitude of the problem. "

Risk aversion has been at an all-time high, causing riskier assets such as stocks to lose ground.

Economists see a bleak outlook for the stock market for the foreseeable future. Global de-risking is likely to continue unless conditions improve in Ukraine, economic research firm Capital Economics said.

Mark Haefele, chief investment officer at USB Global Wealth Management, said the heightened volatility in markets as the conflict escalated suggested the potential for further conflict had not yet been fully factored into the situation, and was announcing how to respond.

Capital Economics believes that the response of the major central banks is also important. Equities are already under pressure from monetary tightening, but such a conflict could prompt authorities to delay or at least slow the tightening process.

High energy prices

Oil prices rose sharply on Thursday amid fears of supply disruptions. Brent, the global standard, was the driving force behind the surge in oil prices, topping $100 a barrel for the first time since 2014.

Mark Haefele, chief investment officer at USB Global Wealth Management, said the heightened volatility in markets as the conflict escalated suggested the potential for further conflict had not yet been fully factored into the situation, and was announcing how to respond.

Capital Economics believes that the response of the major central banks is also important. Equities are already under pressure from monetary tightening, but such a conflict could prompt authorities to delay or at least slow the tightening process.

high energy prices

Oil prices rose sharply on Thursday amid fears of supply disruptions. Brent, the global standard, was the driving force behind the surge in oil prices, topping $100 a barrel for the first time since 2014.

“One hopes that a direct link with Germany will defuse Europe’s energy woes. In Europe, it is one of the most effective ways to counter Russian aggression.

Even without Western sanctions, Russia's energy exports could face a risk premium for some time. This is according to an analysis by Capital Economics.

If the crisis worsens, oil prices could rise sharply, pushing the cost of natural gas in Europe to nearly 180 euros ($201.9) per megawatt-hour, according to Capital Economics forecasts.