A Russian invasion of Ukraine could hurt the U.S. economy, push up gas prices and make it harder to recover from the coronavirus outbreak.

Huge price swings in U.S. crude and stock markets on Thursday underscored the uncertainty over the consequences of the conflict. Crude oil prices rose about 8% to above $100 a barrel before falling back to previous levels. U.S. stocks rebounded from early losses on Thursday, with all three major indexes closing in positive territory.

Still, the president hinted that the conflict could damage the economy and fuel inflation, and pledged to work to protect American households and businesses from rising prices.

Russia's energy exports appear to be unaffected for now. Nonetheless, the possibility of them emerging — through pipeline damage, sanctions or any intentional Russian attempts to restrict the West — underscores the dangers posed by conflict beyond Eastern Europe.

Oil prices have risen in recent months, and that rise is expected to continue as tensions mount.

Inflation has reached its fastest pace in 40 years, making it harder for low-income households to keep up with the rising cost of war.

The survival of many American companies depends on energy prices, especially in the transportation, aviation and trucking industries.

The cost of gasoline in the U.S. has risen by about $1 a gallon since pandemic fears subsided.

Crude oil and gasoline prices have risen in recent weeks on fears of a Russian invasion of Ukraine. Drivers in the U.S. paid $3.53 for a gallon of gas this week.

Rising natural gas costs in the U.S. accounted for almost a quarter of last year's 6.1 percent inflation rate.

A lack of confidence in Putin's next move sent oil and gas prices up and down.

Parts of the U.S. economy are benefiting from higher energy costs as the U.S. is a major producer of natural gas and oil after decades of surging production.

The European economy is also at risk of being disrupted by relying on Russian gas to heat and power many European homes and businesses.

European gas prices rose 33 percent to 118.50 euros ($130) per megawatt-hour on Thursday. Several pipelines transport Russian gas to Europe.

Natural gas flows were unchanged, according to an energy analyst at IHS Markit.

If Russia invades Ukraine, the U.S. could use unprecedented export controls to hurt key Russian industries.

Following the Russian attack, European leaders are stepping up efforts to reduce the continent's reliance on Russian oil and gas. Europe will struggle to quickly replace vast amounts of Russian oil and gas with alternative energy sources, according to a report last week by Britain's Barclays Bank.

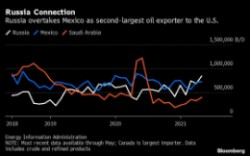

Although Russia's economy is relatively small compared to other countries, the country is the world's third largest oil producer and second largest natural gas producer.

Commentators believe that Russia is unlikely to deliberately reduce exports in the coming months to resist Western sanctions.

Russian exports could be disrupted if Ukrainian pipelines are damaged by hostilities.

In addition, some analysts believe that U.S. and European sanctions on Russian institutions could delay Western payments and affect Russia’s ability to transfer energy to the West.